Table of Contents

The Simple Guide to Decentralized Finance (DeFi)

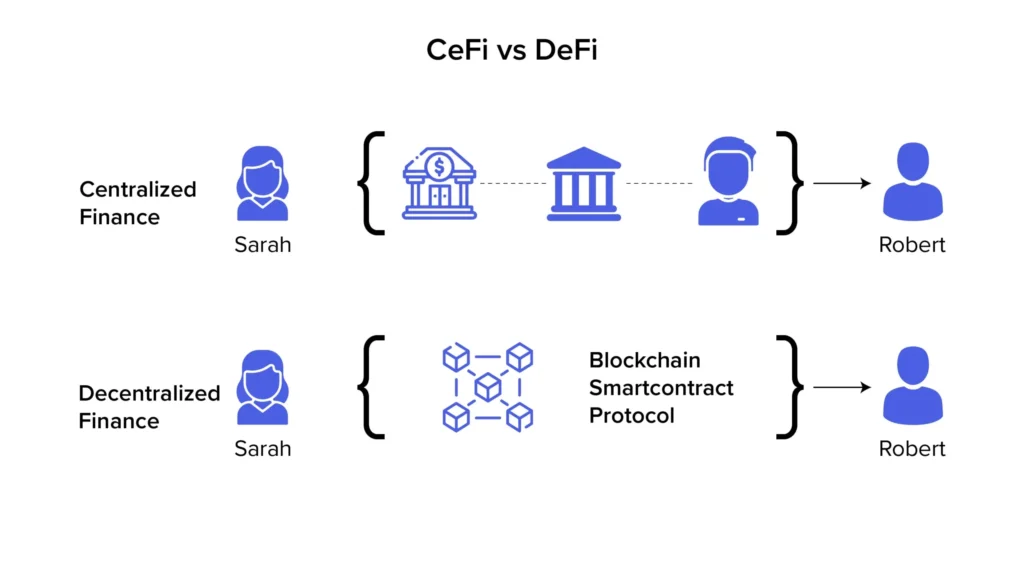

This post is a Simple Guide to understand Decentralized Finance (DeFi) and the technology surrounding the decentralized financial systems. If you’ve followed our posts on Crypto Current Report on NFTs, cryptocurrencies, blockchain, you might have come across the term “DeFi.” It is said to be the future of the financial system that will revolutionize the way we conduct financial transactions. Many believe that DeFi has the potential to disrupt the traditional banking and financial services industries. To understand what decentralized finance is, and how it works, lets first see what centralized finance is and how is it different from decentralized finance?

What is Centralized Finance – CeFi

Centralized finance or CeFi is the current traditional financial system where a bank, finance company is responsible for all your money. CeFi involves third parties who facilitate money transactions between two parties, with each one charging fees for using their services.

What is Decentralized Finance – DeFi

Decentralized Finance Defi is a new financial system that enables the use of peer-to-peer payments on blockchain technology. It does not depend on banks or financial institutions to secure transactions. DeFi systems achieve secure distributed ledger by using “smart contracts” on blockchains majorly on Ethereum. We’ll see more of smart contracts in upcoming crypto current report.

How does DeFi work?

DeFi is primarily based on Ethereum and uses smart contracts and cryptos to offer services that do not require middlemen, government and the banks, in the process of conducting a financial transaction. Smart contracts are often what govern decentralized apps, or “dapps”, which are not owned or managed by any one company or person. Moreover, these smart contracts are public, and anyone can inspect and review them as they carry out a transaction in accordance with the conditions of a contract or agreement. Decentralized applications or Dapps is one of the core uses of DeFi. All decentralized apps have no central authority but rather use smart contracts to execute actions and validate transactions. We’ll cover dApps in detail later in crypto current report.

Application of Defi

This field of financial technology is evolving fast. This system is based on sufficiently secure distributed ledgers. These distributed ledgers resemble the majority of cryptocurrencies in use. To know more on cryptocurrencies, you can read our crypto current report – What is Cryptocurrency? With such a system, banks and other institutions would no longer have any influence on financial services, currency, or financial products. It is regarded as adopting Bitcoin’s fundamental principle. It develops a full digital rival to Wall Street. There are not any expenses connected with it, though. It doesn’t call for any bank salaries or training floors. As a result, there is a greater chance that more open and free financial markets will emerge.

Decentralized Autonomous Organization (DAO)

Decentralized autonomous organization (DAO) is an entity that has no central leadership. Consider them the DeFi equivalent of centralized financial institutions. They are by nature decentralized and do not adhere to the restrictions imposed by centralized authorities or organizations, as their name implies. The backbone of a DAO is its smart contract. So, when the contract is live on Ethereum, the group collectively makes all decisions and no one can change the rules except by a vote. We’ll see more on DAO in upcoming crypto current report.

NFTs in Decentralized Finance

DeFi and NFTs are presently the two most popular applications in the domain of blockchain technology. NFTs have become one of the promising applications in the DeFi sector. With NFTs; ability to represent the commercialization of digital products and services, the NFT decentralized finance combination becomes more practical. Due to how simple it is to demonstrate NFT ownership, NFT holders now have more opportunities to use their NFTs as collateral for loans. DeFi and NFTs may change how we think about assets, tokens, and financial services as a result of the growing number of users. To know more on NFTs, you can read our crypto current report – What is NFT and How Does NFT Work? The Ultimate Guide.

Challenges of Decentralized Finance DeFi

As the Decentralized Finance (DeFi) industry has evolved leveling the playing field for all market participants, regardless of their size or location, has become a significant concern. Another is the requirement for better global regulatory coordination to stop the unauthorized use of DeFi technologies. Finally, as DeFi protocols continue to develop and mature, stronger governance structures must be created to ensure that they can adjust to changing circumstances. DeFi has many difficulties, but there are also many rewards. DeFi is an important step toward attaining financial inclusion for everyone by giving people and communities around the world better access to financial services.

Future of DeFi

It is still early days for the DeFi industry, so who knows what the future will bring? DeFi, however, has the potential to improve the state of finance by lowering entry barriers, expanding access to financial services, and enabling more democratic governance arrangements. Transactions that occur almost instantly and securely are a crucial topic to watch. Transactions might take days or even weeks to clear in traditional finance. With DeFi, this is not the case. Transactions are almost instantaneously finalized thanks to the sector’s decentralized structure, which makes it perfect for time-sensitive activities like lending or trading.

Bottomline

The financial ecosystem is quickly changing and evolving as a result of decentralized finance. As per crypto current reports, there is no denying that DeFi will play a major role in the future of financial services. DeFi offers tremendous potential and amazing advantages. It is now up to us to embrace the financial paradigm shift and see how it will shape the financial world of the future. For more information detailed information you could use the following Source Link.